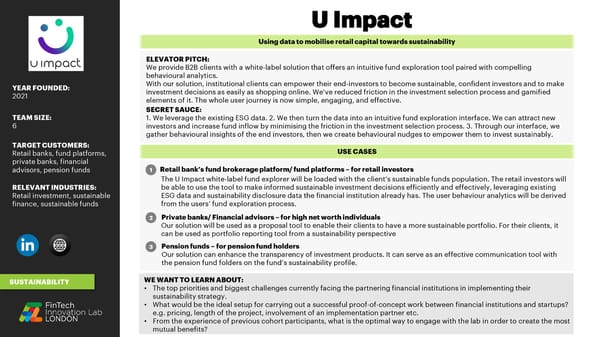

Using data to mobilise retail capital towards sustainability ELEVATOR PITCH: We provide B2B clients with a white-label solution that offers an intuitive fund exploration tool paired with compelling behavioural analytics. YEAR FOUNDED: With our solution, institutional clients can empower their end-investors to become sustainable, confident investors and to make 2021 investment decisions as easily as shopping online. We’ve reduced friction in the investment selection process and gamified elements of it. The whole user journey is now simple, engaging, and effective. SECRET SAUCE: TEAM SIZE: 1. We leverage the existing ESG data. 2. We then turn the data into an intuitive fund exploration interface. We can attract new 6 investors and increase fund inflow by minimising the friction in the investment selection process. 3. Through our interface, we gather behavioural insights of the end investors, then we create behavioural nudges to empower them to invest sustainably. TARGET CUSTOMERS: USE CASES Retail banks, fund platforms, private banks, financial advisors, pension funds 1 Retail bank’s fund brokerage platform/ fund platforms –for retail investors The U Impact white-label fund explorer will be loaded with the client’s sustainable funds population. The retail investors will RELEVANT INDUSTRIES: be able to use the tool to make informed sustainable investment decisions efficiently and effectively, leveraging existing Retail investment, sustainable ESG data and sustainability disclosure data the financial institution already has. The user behaviour analytics will be derived finance, sustainable funds from the users’ fund exploration process. 2 Private banks/ Financial advisors –for high net worth individuals Our solution will be used as a proposal tool to enable their clients to have a more sustainable portfolio. For their clients, it can be used as portfolio reporting tool from a sustainability perspective 3 Pension funds –for pension fund holders Our solution can enhance the transparency of investment products. It can serve as an effective communication tool with the pension fund folders on the fund’s sustainability profile. SUSTAINABILITY WE WANT TO LEARN ABOUT: • The top priorities and biggest challenges currently facing the partnering financial institutions in implementing their sustainability strategy. • What would be the ideal setup for carrying out a successful proof-of-concept work between financial institutions and startups? e.g. pricing, length of the project, involvement of an implementation partner etc. • From the experience of previous cohort participants, what is the optimal way to engage with the lab in order to create the most mutual benefits?

FIL 2023 Cohort Booklet Page 7 Page 9

FIL 2023 Cohort Booklet Page 7 Page 9