FinTech Innovation Lab London Intro

Interactive Presentation | Overview Pack of Fintech Innovation Lab London 2020 | 8 pages

BRILLIANCE. ACCELERATED.

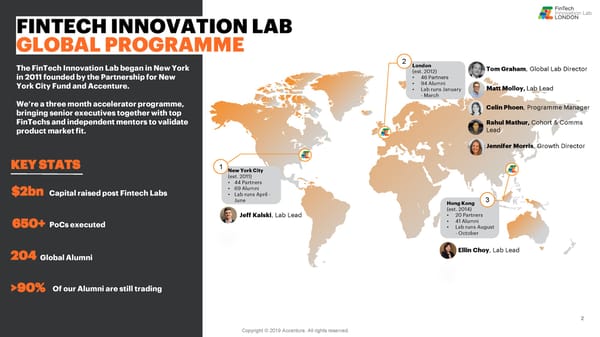

FINTECH INNOVATION LAB GLOBAL PROGRAMME The FinTech Innovation Lab began in New York 2 London (est. 2012) Tom Graham, Global Lab Director in 2011 founded by the Partnership for New " 46Partners York City Fund and Accenture. " 94 Alumni Matt Molloy, Lab Lead " Labruns January - March We9re a three month accelerator programme, Celin Phoen, Programme Manager bringing senior executives together with top FinTechsand independent mentors to validate Rahul Mathur, Cohort & Comms product market fit. Lead Jennifer Morris, Growth Director KEY STATS 1 New York City (est. 2011) " 44 Partners $2bn Capital raised post Fintech Labs " 69 Alumni " Lab runs April - June Hong Kong 3 (est. 2014) Jeff Kalski, Lab Lead " 20 Partners 650+PoCsexecuted " 41 Alumni " Lab runs August - October 204 Ellin Choy, Lab Lead Global Alumni >90% Of our Alumni are still trading Copyright © 2019 Accenture. All rights reserved.

45+ PARTNERS ARE PARTICIPATING IN THE 2020 LONDON PROGRAMME Copyright © 2019 Accenture. All rights reserved.

THE LONDON FINTECH COHORT IS ORGANISED INTO 5 WORKSTREAMS TIMELINE CAPITAL MARKETS REG TECH ENTERPRISE TECH INSURTECH OPEN DATA Technology that is Technology solutions Enabler technology Technology that Data and services augmenting or that facilitate the leveraging disruptive enables the creation, available across the replacing established delivery of regulatory technology such as distribution and ecosystem which can business processes. compliance and cyber cloud, automation, AI, administration of be used for enhanced Including securities resilience; including machine learning, insurance business propositions for issuance, trading, activities such as blockchain to help consumers or wealth management, monitoring, reporting, Financial Services businesses. clearance & process improvement clients deliver new settlement. and enhancing capabilities and capability. experiences at enterprise scale Copyright © 2019 Accenture. All rights reserved.

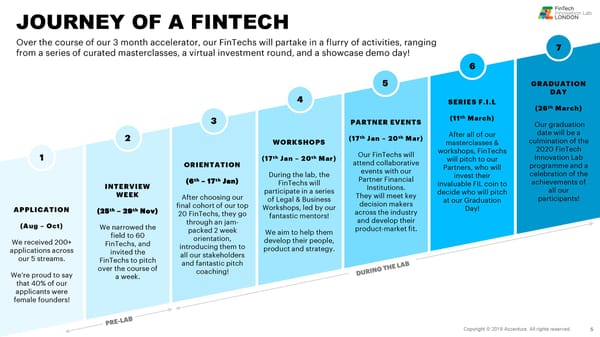

JOURNEY OF A FINTECH Over the course of our 3 month accelerator, our FinTechs will partake in a flurry of activities, ranging 7 from a series of curated masterclasses, a virtual investment round, and a showcase demo day! 6 5 GRADUATION 4 DAY SERIES F.I.L (26th March) 3 PARTNER EVENTS (11th March) Our graduation th th After all of our date will be a 2 WORKSHOPS (17 Jan 3 20 Mar) masterclasses & culmination of the Our FinTechswill workshops, FinTechs 2020 FinTech 1 th th Innovation Lab ORIENTATION (17 Jan 3 20 Mar) attend collaborative will pitch to our events with our Partners, who will programme and a During the lab, the invest their celebration of the th th Partner Financial INTERVIEW (6 3 17 Jan) FinTechswill Institutions. invaluable FIL coin to achievements of WEEK participate in a series They will meet key decide who will pitch all our After choosing our of Legal & Business decision makers at our Graduation participants! APPLICATION th th final cohort of our top Workshops, led by our Day! (25 3 29 Nov) 20 FinTechs, they go fantastic mentors! across the industry (Aug 3 Oct) We narrowed the through an jam- and develop their field to 60 packed 2 week We aim to help them product-market fit. We received 200+ FinTechs, and orientation, develop their people, applications across invited the introducing them to product and strategy. our 5 streams. FinTechsto pitch all our stakeholders over the course of and fantastic pitch coaching! We9re proud to say a week. that 40% of our applicants were female founders! Copyright © 2019 Accenture. All rights reserved. Copyright © 2019 Accenture. All rights reserved.

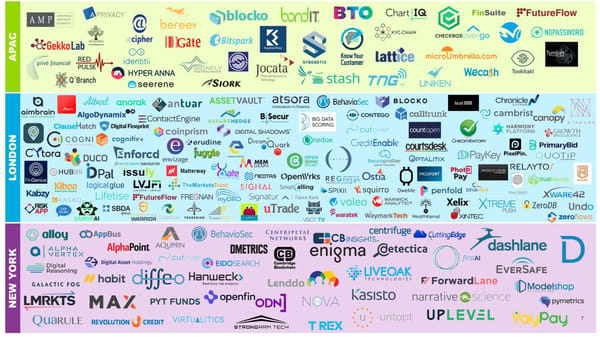

NOTABLE GLOBAL ALUMNI 204 Global Alumni >90% Are still operating $1.9bn Funding post lab and growing* Founded in 2013, TNG is committed to Wecashhelps analyzeChinese This enterprise behavioral analytics bringing its leading-edge technology customers9 credit. Customers sign up company helps hedge funds, asset to enhance the life of Hong Kong for the app, provide information to the managers and banks systematically CA people through its next generation company and within 15 minutes, improve investment performance and P payment, money transfer and lifestyle receive a credit evaluation. conduct management at the A management solutions. individual, team and company level. A Chinese unicorn with a userbase of Record Series A Fundraising of over 130 million Acquired by NASDAQ in 2017 US$115m Founded in 2011, Digital Shadows Founded in 2010, Duco9s technology Cytoratransforms underwriting for minimises digital risk by identifying enables financial institutions to normalise, commercial insurance. The Cytora Risk unwanted exposure, detecting data validate and reconcile any type of data in Engine uses artificial intelligence to learn DONloss and securing your online brand. Duco9s cloud, providing firms with on- the patterns of risks over time, enabling N demand data integrity and insight. insurers to underwrite more efficiently O Digital Shadows Named "Leader" in and deliver fairer prices to customers. L 2018 Forrester New Wave for

THE FINTECH INNOVATION LAB HAS BEEN HUGELY BENEFICIAL. WE HAVE BEEN ABLE TO CARRY OUT 12 MONTHS WORTH OF MARKET VALIDATION AND PROPOSITION REFINEMENT WITHIN 12 WEEKS. IF THAT9S NOT ACCELERATION I DON9T KNOW WHAT IS. OLLY BETTS FOUNDER & CEO OPENWRKS Copyright © 2019 Accenture. All rights reserved.