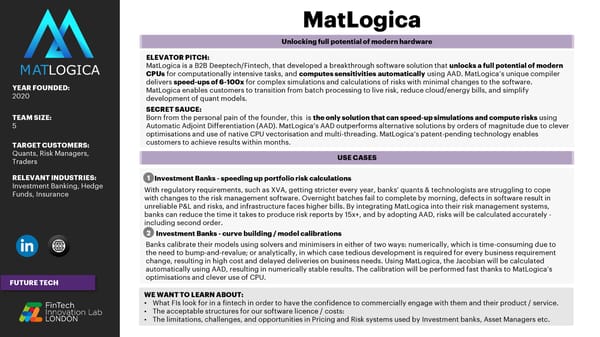

MatLogica Unlocking full potential of modern hardware ELEVATOR PITCH: MatLogicais a B2B Deeptech/Fintech, that developed a breakthrough software solution that unlocks a full potential of modern CPUsfor computationally intensive tasks, and computes sensitivitiesautomatically using AAD. MatLogica’sunique compiler YEAR FOUNDED: delivers speed-ups of 6-100xfor complex simulations and calculations of risks with minimal changes to the software. 2020 MatLogicaenables customers to transition from batch processing to live risk, reduce cloud/energy bills, and simplify development of quant models. SECRET SAUCE: TEAM SIZE: Born from the personal pain of the founder, this is the only solution that can speed-up simulations and compute risks using 5 Automatic Adjoint Differentiation (AAD). MatLogica’sAAD outperforms alternative solutions by orders of magnitude due to clever optimisations and use of native CPU vectorisation and multi-threading. MatLogica’spatent-pending technology enables TARGET CUSTOMERS: customers to achieve results within months. Quants, Risk Managers, USE CASES Traders RELEVANT INDUSTRIES: 1 Investment Banks -speeding up portfolio risk calculations Investment Banking, Hedge Funds, Insurance With regulatory requirements, such as XVA, getting stricter every year, banks’ quants & technologists are struggling to cope with changes to the risk management software. Overnight batches fail to complete by morning, defects in software result in unreliable P&L and risks, and infrastructure faces higher bills. By integrating MatLogica into their risk management systems, banks can reduce the time it takes to produce risk reports by 15x+, and by adopting AAD, risks will be calculated accurately - including second order. 2 Investment Banks -curve building / model calibrations Banks calibrate their models using solvers and minimisers in either of two ways: numerically, which is time-consuming due to the need to bump-and-revalue; or analytically, in which case tedious development is required for every business requirement change, resulting in high cost and delayed deliveries on business needs. Using MatLogica, the Jacobian will be calculated automatically using AAD, resulting in numerically stable results. The calibration will be performed fast thanks to MatLogica’s FUTURE TECH optimisations and clever use of CPU. WE WANT TO LEARN ABOUT: • What FIs look for in a fintech in order to have the confidence to commercially engage with them and their product / service. • The acceptable structures for our software licence / costs: • The limitations, challenges, and opportunities in Pricing and Risk systems used by Investment banks, Asset Managers etc.

FIL 2023 Cohort Booklet Page 26 Page 28

FIL 2023 Cohort Booklet Page 26 Page 28