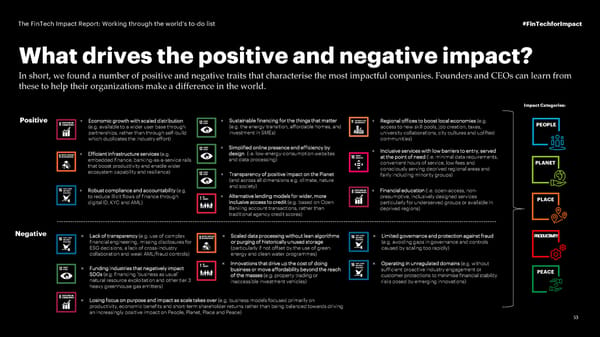

The FinTech Impact Report: Working through the world’s to-do list #FinTechforImpact What drives the positive and negative impact? In short, we found a number of positive and negative traits that characterise the most impactful companies. Founders and CEOs can learn from these to help their organizations make a difference in the world. Impact Categories: Positive + Economic growth with scaled distribution + Sustainable financing for the things that matter + Regional offices to boost local economies (e.g. PEOPLE (e.g. available to a wider user base through Icon (e.g. the energy transition, affordable homes, and Icon access to new skill pools, job creation, taxes, Icon partnerships, rather than through self-build investment in SMEs) university collaborations, city cultures and uplifted which duplicates the industry effort) communities) + Simplified online presence end efficiency by + Inclusive services with low barriers to entry, served + Efficient infrastructure services (e.g. Icon design (i.e. low-energy-consumption websites at the point of need (i.e. minimal data requirements, embedded finance, banking-as-a-service rails and data processing) Icon convenient hours of service, low fees and PLANET Icon that boost productivity and enable wider consciously serving deprived regional areas and ecosystem capability and resilience) + Transparency of positive impact on the Planet fairly including minority groups) Icon (and across all dimensions e.g. climate, nature + Robust compliance and accountability (e.g. and society) + Financial education (i.e. open-access, non- to reduce illicit flows of finance through + Alternative lending models for wider, more presumptive, inclusively designed services PLACE digital ID, KYC and AML) Icon inclusive access to credit (e.g. based on Open particularly for underserved groups or available in Banking account transactions, rather than deprived regions) traditional agency credit scores) Negative × Lack of transparency (e.g. use of complex × Scaled data processing without lean algorithms × Limited governance and protection against fraud PRODUCTIVITY financial engineering, missing disclosures for Icon or purging of historically unused storage (e.g. avoiding gaps in governance and controls ESG decisions, a lack of cross-industry (particularly if not offset by the use of green caused by scaling too rapidly) collaboration and weak AML/fraud controls) energy and clean water programmes) × Funding industries that negatively impact × Innovations that drive up the cost of doing × Operating in unregulated domains (e.g. without SDGs (e.g. financing ‘business as usual’ Icon business or move affordability beyond the reach sufficient proactive industry engagement or PEACE natural resource exploitation and other tier 3 of the masses (e.g. property trading or customer protections to minimise financial stability heavy greenhouse gas emitters) inaccessible investment vehicles) risks posed by emerging innovations) × Losing focus on purpose and impact as scale takes over (e.g. business models focused primarily on Icon productivity, economic benefits and short-term shareholder returns rather than being balanced towards driving an increasingly positive impact on People, Planet, Place and Peace) 53

The FinTech Impact Report: Working through the world’s to-do list Page 52 Page 54

The FinTech Impact Report: Working through the world’s to-do list Page 52 Page 54