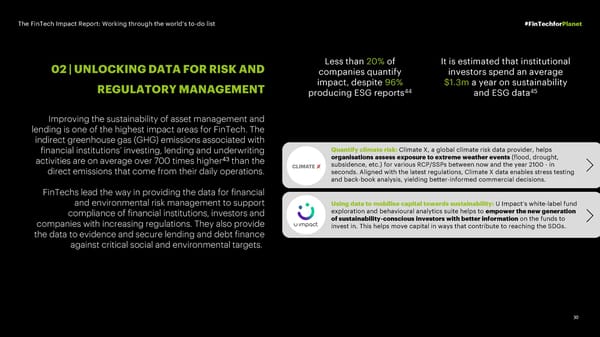

The FinTech Impact Report: Working through the world’s to-do list #FinTechforPlanet 02 | UNLOCKING DATA FOR RISK AND Less than 20% of It is estimated that institutional companies quantify investors spend an average impact, despite 96% $1.3m a year on sustainability REGULATORY MANAGEMENT producing ESG reports44 and ESG data45 Improving the sustainability of asset management and lending is one of the highest impact areas for FinTech. The indirect greenhouse gas (GHG) emissions associated with Quantify climate risk: Climate X, a global climate risk data provider, helps financial institutions’ investing, lending and underwriting organisations assess exposure to extreme weather events (flood, drought, 43 activities are on average over 700 times higher than the subsidence, etc.) for various RCP/SSPs between now and the year 2100 - in direct emissions that come from their daily operations. seconds. Aligned with the latest regulations, Climate X data enables stress testing and back-book analysis, yielding better-informed commercial decisions. FinTechs lead the way in providing the data for financial and environmental risk management to support Using data to mobilise capital towards sustainability: U Impact’s white-label fund compliance of financial institutions, investors and exploration and behavioural analytics suite helps to empower the new generation companies with increasing regulations. They also provide of sustainability-conscious investors with better information on the funds to invest in. This helps move capital in ways that contribute to reaching the SDGs. the data to evidence and secure lending and debt finance against critical social and environmental targets. 30

The FinTech Impact Report: Working through the world’s to-do list Page 29 Page 31

The FinTech Impact Report: Working through the world’s to-do list Page 29 Page 31