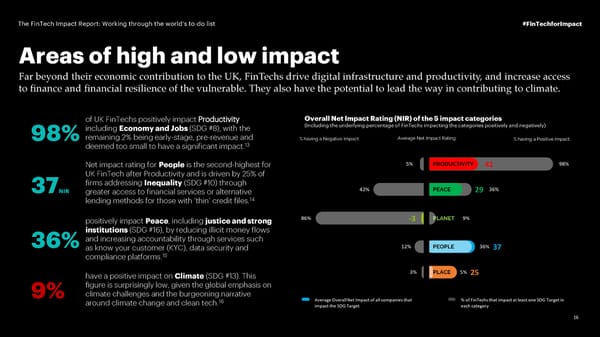

The FinTech Impact Report: Working through the world’s to-do list #FinTechforImpact Areas of high and low impact Far beyond their economic contribution to the UK, FinTechs drive digital infrastructure and productivity, and increase access to finance and financial resilience of the vulnerable. They also have the potential to lead the way in contributing to climate. of UK FinTechs positively impact Productivity Overall Net Impact Rating (NIR) of the 5 impact categories including Economy and Jobs (SDG #8), with the (Including the underlying percentage of FinTechs impacting the categories positively and negatively) 98%remaining 2% being early-stage, pre-revenue and deemed too small to have a significant impact.13 Net impact rating for People is the second-highest for UK FinTech after Productivity and is driven by 25% of 37NIR firms addressing Inequality (SDG #10) through greater access to financial services or alternative 14 lending methods for those with ‘thin’ credit files. positively impact Peace, including justice and strong institutions (SDG #16), by reducing illicit money flows 36%and increasing accountability through services such as know your customer (KYC), data security and compliance platforms.15 have a positive impact on Climate (SDG #13). This figure is surprisingly low, given the global emphasis on 9% climate challenges and the burgeoning narrative around climate change and clean tech.16 16

The FinTech Impact Report: Working through the world’s to-do list Page 15 Page 17

The FinTech Impact Report: Working through the world’s to-do list Page 15 Page 17